As growth in the number of paid music streaming subscribers slows in the US, some have theorized that Baby Boomers are the key to unlocking more paying customers.

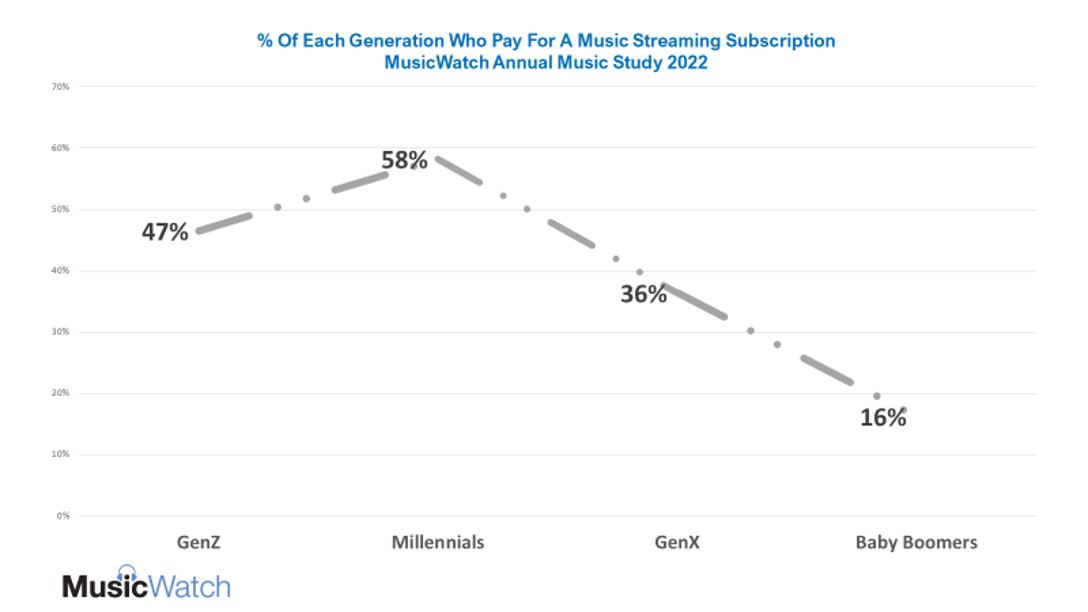

It has become popular to talk about Baby Boomers as the saviors for the next wave of growth in music streaming subscriptions. This notion started after analysts latched on to the low levels of subscription penetration for Boomers which was described in various research reports. Here is similar data from MusicWatch’s Annual Music Study, and it too shows that Boomers are woefully under-represented when it comes to paying for music streaming subscriptions. Considering there are 52 million internet using Boomers in the US, and only about 16%, or 8 million, pay for a subscription, you’d have to agree that there’s a lot of unplowed territory among this age group. Of course, it is Boomers who pride themselves as modern music’s “greatest generation”. If you could convince close to half to pay for an on-demand service, that would grow the US subscriber base by 20 percent. After reading multiple articles about the potential of Boomers, I envisioned Tim, Lyor and Daniel racing to make media buys on the CBS Evening News- right next to remedies for arthritis, psoriasis, and persistent Gerd.

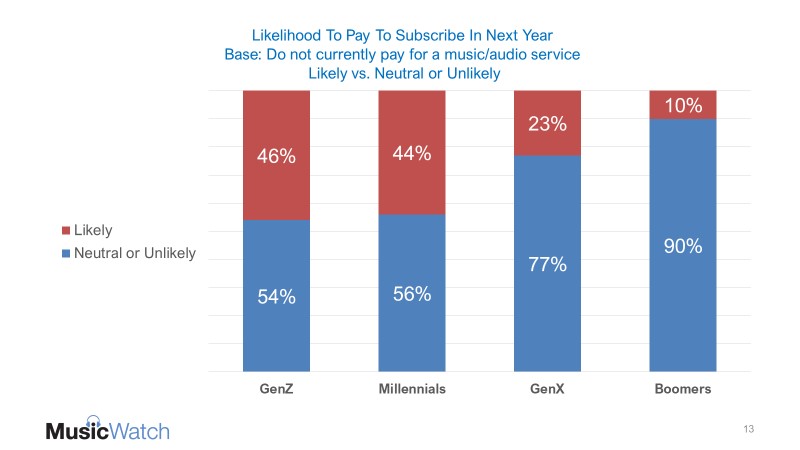

Bursting the Bubble. The penetration data tells a story, but only a small part. In the MusicWatch studies we went a few steps further. We asked whether non-payers were at all interested in paying for a music subscription. As the graph below illustrated, Boomers woefully underperform when it comes to likelihood to convert. Only ten percent indicated they were likely to pay to subscribe to an audio service in the coming year. We know from experience that, when push comes to shove, many of these so-called likely subscribers won’t actually sign up.

Good is Good Enough. The reasons why Boomers are not interested in paying for an audio subscription are straightforward. They are satisfied with radio, which many still use to listen to music. They are satisfied with their collections of CDs and downloads, which many still listen to. They are satisfied with the available ad-supported streaming options, and the commercials don’t bother them too much. Or they simply don’t listen to music enough to see value in the monthly fee.

Who then? Deeper analysis shows that mining the younger demographic would provide a greater return on investment than trying to convince Baby Boomers to pay. As the chart above shows, the younger demographic has a large proportion who still do not pay, and the likelihood of converting them is much better.

Are Boomers A Lost Cause? Not necessarily. Boomers have shown a willingness to pay for subscriptions, just not the on-demand type. They subscribe to Amazon Prime and listen to Prime Music. They are 50 percent more likely to have a SiriusXM subscription than an on-demand subscription. In addition to music, Sirius offers a plethora of content including news, sports and curated channels that appeals to older (and younger) listeners. Perhaps attracting Boomers means a content play. Perhaps it is a pricing play. Would a tiered pricing scheme appeal to the more casual music listener? Three out of four Boomers now stream music. It’s worth a look to see how more could be converted to paid subscribers. But it is highly unlikely they will change the growth trajectory of subscriptions in the short term.