Demand isn’t there today, but there’s a payoff if it can be unlocked.

Lucien Grange and Robert Kyncl, leaders of Universal Music and Warner Music respectively, received a lot of notice last week for suggesting that music fandom was sorely under monetized. Both see squeezing more dollars from music fans as a path to growth. Kyncl was quoted in CMU as saying… “We need to develop our direct artist-superfan products and experiences”, he notes. “Both artists and superfans want deeper relationships, and it’s an area that’s relatively untapped and under-monetised”.

He’s correct about the latter. However, consumer research suggests that most fans aren’t ready to spend to enhance those relationships.

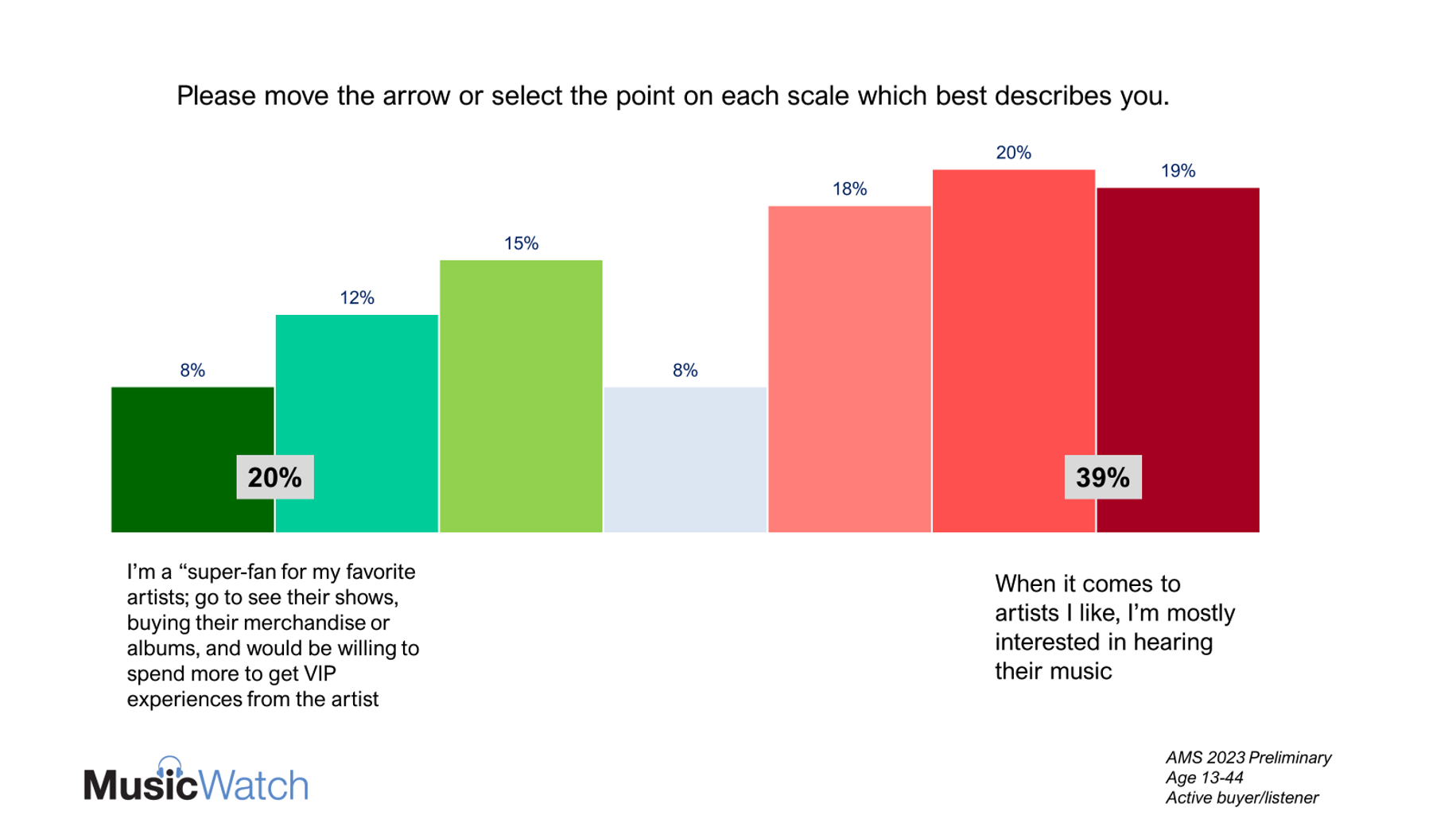

MusicWatch examined several elements of fanship in our soon to be released Annual Music Study. The area is indeed untapped. Looking at 13–44-year-olds who listen to or buy music, only 3 percent purchased a VIP Package during 2023. These VIP packages are specially created by artists for fans, and could include ticket bundles, exclusive or special release CDs or Vinyl, a merch bundle, or something similar. Only 10 percent of these fans are interested in tipping, direct to artist payments or crowdfunding for artists. We asked respondents in the Annual Music Study to describe themselves across a series of music related questions, including likelihood to engage in superfan experiences. The results, across a seven-point scale, are shown below:

What the data says is that 39 percent are mostly interested in engaging with artists by listening to their music, whereas only 20 percent are interested in connecting as superfans.

The numbers are mildly depressing and suggest modest potential for monetizing superfans. They imply that fans will continue to stream favorite artists and follow them on socials, but not necessarily open their wallets. There is a big difference between liking an artist (and streaming them a lot) and wanting to buy superfan product or experiences.

CDs and Vinyls offer some touchpoints for optimism. Many fans are buying CDs and Vinyl records as expressions of fanship. In a 2022 MusicWatch study of Vinyl buyers, one-third said they buy vinyl to support the artists. About one in eight vinyl buyers purchased Vinyls just for collecting, and to specifically support artists, even though they may also listen to their music in other ways. In 2022 we were astonished to see an uptick in CD buying among Gen Z, thanks to artists such as Taylor, Harry Styles and BTS. Our research showed that half of GenZ CD buyers didn’t listen to CDs. This recent history points to fans stepping up when the product is compelling, and the marketing is exciting. To paraphrase Steve Jobs, consumers don’t always know what they want until it hits the market. The job of the artist teams at Universal and Warner is to unlock that demand and move more fans from the liking (listening) side of the ledger to the wanting (paying) side.

The key to Kyncl’s statement is “we need to develop”. What if 10 percent of fans aged 13-44 bought into a VIP package, instead of today’s 3 percent? And what if each of those fans spent $100 each year? That translates to ten million fans adding ONE BILLION incremental dollars to the US recorded music industry. And that indeed is super.