Audio is a category ripe for segmentation. Genres are a great start. If I say Classic Rock or HipHop what vastly different imagery comes to mind? We can create similar images by showing someone who prefers listening to music on radio, versus one who favors streaming. Then there’s age demographics and groupings such as GenZ. The problem with all this is that we’re assuming all Classic Rock fans are older or that all of the 75 million GenZ population listen to audio in just the same way.

We looked at audio habits from a different perspective, starting with a view of how listening changes each year between ages 13 to 99. Specifically, we examined the hours that each age group spent listening to music and podcasts, and how interested they were in programming such as news or sports1. The spectrum of music ranged from owned formats such as CDs, downloads or vinyl, to streaming, music livestreams, music on TV and music on social media and video platforms such as TikTok.

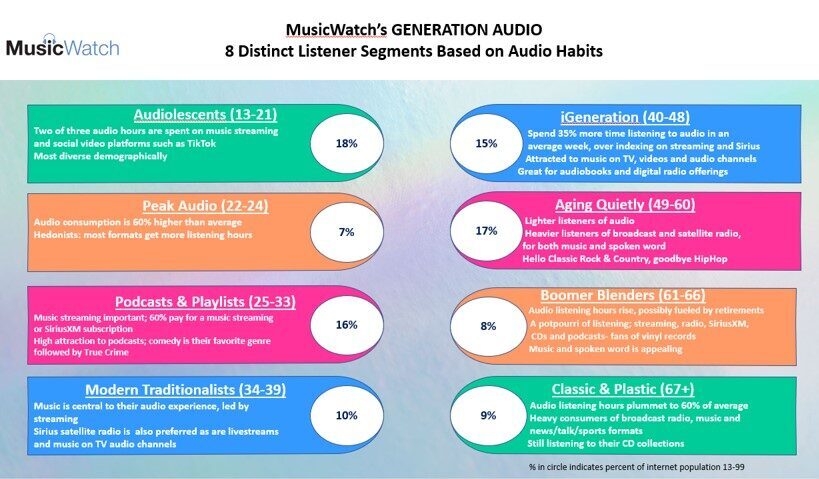

Looking at the hours that they spent, and the share of those hours revealed eight distinct “audio clusters”.

Audiolescents (18%2)

Aged between 13 and 21, you’d guess that this group was the heaviest consumer of audio content. You’d have guessed wrong. They are only average consumers of audio content based on weekly listening time. Music streaming and listening to or watching music in videos from TikTok or similar short-form platforms accounts for 61% of their listening time. Nothing else comes close. They haven’t yet adopted the podcasting habit. They do have a bit of an itch for downloads- yes, the kind their parents might have relied on during the peak of the iTunes boom.

The most diverse group ethnically, nearly all (85%) are students. Not surprisingly their favorite genre is HipHop.

Peak Audio (7%)

Small but significant, Peak Audio represents 22–24-year-olds. They consume audio at a rate 60% higher than average. On the basis of listening hours, you might describe them as music hedonists, since every format gets above average attention from this group; radio, TV, streaming, owned, social, and livestreams.

Three out of four are employed, creating disposable income that many use to pay for a subscription to music streaming service or SiriusXM satellite radio. HipHop is this group’s favorite genre, by far.

Podcasts & Playlists (16%)

As they settle into careers and families, audio listening of these 25–33-year-olds dips from the peak, but is still robust. More than a quarter of their listening goes to music streaming, and they also have an appetite for music livestreams. This is the highest indexing group when it comes to podcasts, where they spend 1 in 10 audio hours. Their favorite podcast genre is Comedy, followed closely by True Crime. Listening to music on social platforms continues to be important, but we see a shift from video apps like TikTok and Reels to traditional apps such as Facebook and Twitter. They are the top group when it comes to attending live music events at clubs, arenas or festivals.

We start to see family size expanding, a pattern that holds for the next two segments. Nearly 6 in 10 pay for a music or Sirius subscription

Modern Traditionalists (10%)

Modern Traditionalists, aged 34-39, represent a turning point whereby music streaming is by far the leading form of listening, with nearly a third of hourly share, and engagement with music on social video platforms begins to wane. Complementing the passion for music on streaming platforms, this group is also attracted to music on Sirius satellite radio and TV audio channels, as well as livestreams.

HipHop remains the top genre for this segment, and 53% pay for a music or Sirius subscription.

iGeneration (15%)

The generation that grew up with iTunes and iPods in the early 2000’s has grown into their 40’s- 40-48 to be exact. While the iPods are gathering dust in a drawer, their appetite for audio is robust. They spend 35% more time than average listening to audio. They spend an hour more each week streaming music, but that’s not what makes this segment unusual. Toddlers when MTV launched, iGeneration is the group most attracted to music on TV, whether listening to music channels or watching music video programming. They also over-index on listening to vinyl records.

“I want my MTV” has been replaced by “I want my SXM”, as listening to music on Sirius satellite radio is nearly 40% higher among this segment.

Growing up during a time when many lamented that “nobody will pay for music anymore”, 50% are paying subscribers to an audio service.

The “digital native” label sticks when it comes to spoken word. Though iGeneration are only average consumers of broadcast news, traffic or sports, they way over-index when it comes to audiobooks and digital music and talk offerings from radio broadcasters.

Aging Quietly (17%)

Life seems to be getting in the way of audio listening for this group. Aged 49-60, they are the “lightest” consumers of audio, averaging only 16 hours per week. They partake in all formats of audio entertainment, but nearly across the board they spend less time than other groups. They are, however, heavier consumers of radio, both broadcast and satellite. Their music listening on these formats is higher than most, and they also tune in to spoken word on AM/FM and Sirius.

The tipping point for genres happens here, with two of three listening to Classic Rock, and only a quarter enjoying HipHop. Country becomes a key genre. The rate of subscribing to an audio service drops by half compared to the younger segments, though one-in-four do pay. Family size also shrinks, as the kids are off to college or starting their own households.

Boomer Blenders (8%)

Is it possible that grandparents could spend as much time with audio as their teen grandkids? It sure is. Boomer Blenders aged 61-66 average 22 hours of audio each week, even more if you add in their broadcast news or sports consumption. Half of Boomer Blenders are retired, which frees up time to listen. They accumulate all those hours by spreading it across formats. One-in-five hours is music streaming. Add to that a healthy dose of listening on broadcast radio, Sirius satellite radio, CDs, downloads, and podcasts and it’s easy to see how the hours add up. This is also a sweet spot for vinyl. The generation that grew up with physical formats and owning music hasn’t let go.

They’re a bit soft when it comes to digital spoken word such as audiobooks and web-based news, traffic and sports but they’re 30% stronger listeners of spoken word on broadcast radio.

Classic & Plastic (9%)

Representing ages 67 and older, this group’s listening is 60% lower than average. They are more than twice as likely to listen to music on broadcast AM/FM, and 40% more likely to also be listening to News/Traffic/Sports on radio- but not too much on broadcaster’s digital platforms. Classic & Plastic also like SiriusXM and are more than twice as likely to be listening to Satellite Radio. CDs account for 16% of their music and podcast time, nearly 4 times as much as the average. Here’s the surprise about our oldest group- many are music streamers. In fact, when it comes to just music they spend as much time streaming as they do listening on broadcast radio.

1.To conduct the analysis MusicWatch examined listening hours for music on owned formats such as CD’s, Vinyl and paid downloads, streaming including YouTube used for music watching or listening, social media and social video platforms, TV, music livestreams, SiriusXM Satellite Radio, AM/FM radio (digital and broadcast) as well as podcasts (all genres). MusicWatch also examined listening to spoken word (news, traffic, sports) on broadcast and digital platforms. The source of the data was MusicWatch’s audiocensus Study from Q2 2022. Categories were based on total weekly audio time, share of listening across formats and an index to the total population. Index refers to how the listening hours compare within segment to the total population, with an index of 100 being average, and indexes above 120 generally indicating above average attraction to a format or genre.

2. Numbers in ( ) reflect the percent of internet using population 13 and older.