Synamedia, a UK company announced this year at CES tools to help video service providers monitor and manage account sharing ( http://bit.ly/37S3dJn ). Tom Rutledge, CEO of Charter Communications was quoted in Hollywood Reporter’s December 9 issue as suggesting that the video providers were “creating havoc” with lax security around passwords. There are a multitude of reasons why consumers share passwords. Some believe it’s a harmless indiscretion, while others want access to more original content without having to subscribe to multiple services.

Fortunately, music generally avoids the problem that original content creates for video. While you need three different subscriptions to watch The Handmaid’s Tale (Hulu), Mrs. Maisel (Amazon), and Russian Doll (Netflix), you can mostly find the same music on Apple, Spotify, Pandora or Amazon. It is reasonable to predict that as more video services roll out the problem of password sharing will blossom. Consumers will want to view original content across multiple video services, but may be unwilling to subscribe to more than one or two services.

A decade ago more music was obtained through sharing of CDs and on P2P networks than was purchased from physical or digital retailers. Music subscription services took credit for dampening these forms of piracy, and rightfully so. But, the music DSP’s (digital service providers) are not immune from account sharing, which diminishes true “ARPU” (average revenue per user) 1.

MusicWatch has been tracking account sharing and use of family plans for some time. The following conversation is primarily sourced from MusicWatch’s Monitor series of consumer research conducted during 2019.

KEY TAKEAWAYS

- Many subscribers are illicitly sharing their music subscription log-ins

- Stricter enforcement would likely lead to some conversion to new accounts, but most would revert to ad-supported options

- There is an opportunity to improve consumer understanding of the ground rules

- Artists and other rights holders need to help with messaging to overcome a lack of consumer understanding, and perhaps a lack of empathy, around account sharing

SHARING OF MUSIC ACCOUNTS IS WIDESPREAD IN THE US AND, IN THEORY, COSTS THE INDUSTRY ONE BILLION DOLLARS IN REVENUE

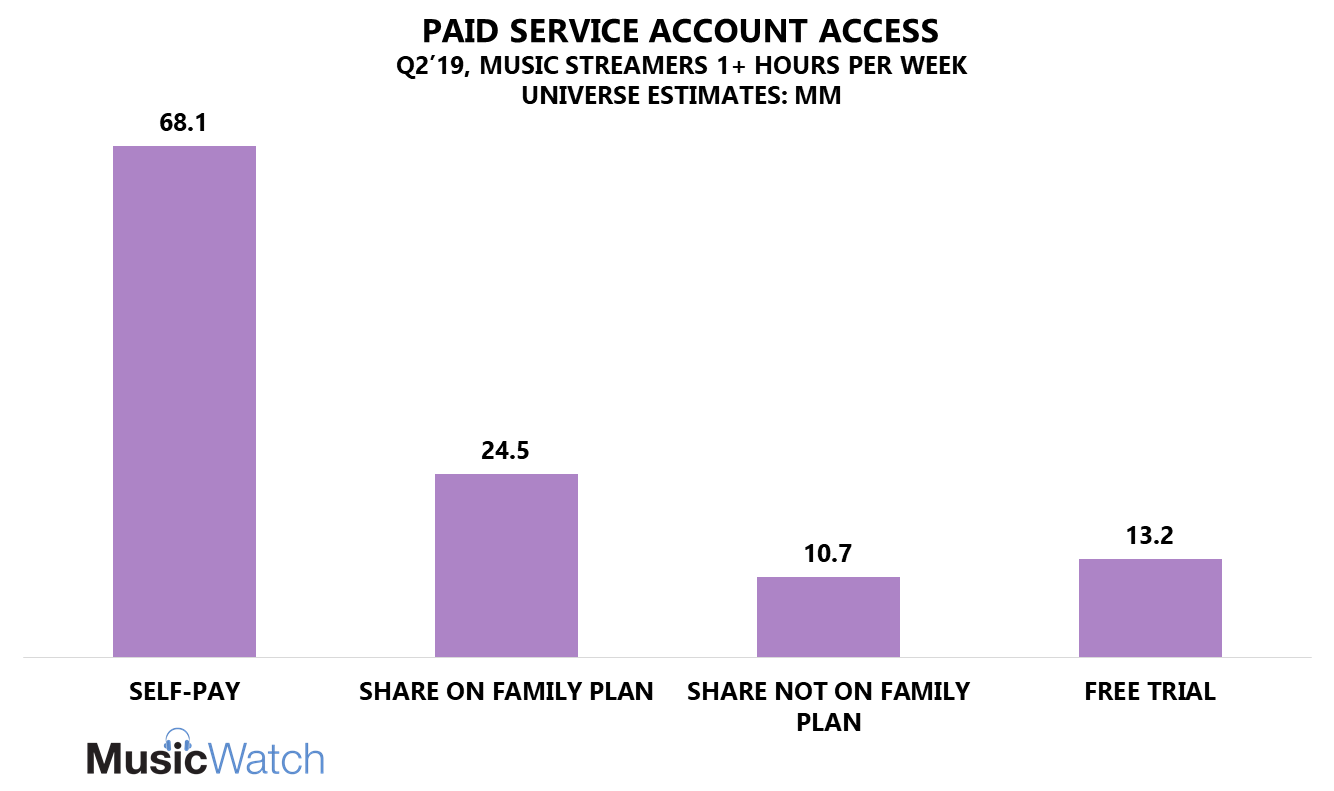

In the quarter ending July 2019 MusicWatch estimated that 95 million people had used one of the major streaming services2. Of these, 68 million were self-paying, 25 million had access through a family plan, 13 million were on a free trial and 11 million were “mooching” or sharing a log-in that was not from an authorized family plan.

Among paid subscribers who don’t use a family plan, ONE IN THREE (32 percent) SHARE THEIR LOG-IN with someone else. Sharing is more pervasive among Millennials aged 25-44, with 44 percent giving out a log-in.

Analysts like to assign a value to these numbers, and in theory, those 10.7 million moochers would be worth $995M, using an ARPU figure of $933. In reality the number would be less, as many moochers would revert to an ad supported version.

30 PERCENT OF MOOCHERS SAY THAT THEY WOULD PAY FOR A SUBSCRIPTION

What would moochers do if their account access was discontinued? Among the 10.7M moochers, an estimated 3.2 million (30 percent) claimed that they would pay for access. Assuming that they all actually converted that would represent $298M in annual revenues using the ARPU figure of $93. That translates to an incremental 6% of the calendar 2018 on-demand US subscription revenues (RIAA). Most of the remaining 70 percent would continue to stream, but switch to a free service, which at least supports ad-based revenues.

THERE IS A LACK OF CLARITY AROUND FAMILY PLANS

We asked subscribers whether the service that they personally pay for was a family plan. Among those who subscribe to Apple Music, Spotify Premium, Google Play or premium Pandora offerings, two-thirds (65 percent) indicated that their account was a family plan. From other MusicWatch research we know that this proportion is overstated by a factor of about three. Perhaps consumers who already share their log-in, or know that they can, confuse that with a legitimate premium family plan.

The lack of clarity doesn’t end there. Among those who share premium services from Apple, Pandora or Spotify ONE IN FIVE believe that their service DOES NOT offer a family plan. Of course, all three companies do offer a family plan.

THE GROUND RULES ARE UNCLEAR TO MANY

In the days of P2P piracy there came a tipping point where most consumers understood that file sharing platforms were, as kids say, shady. There’s somewhat less clarity around today’s account sharing. Most startling is more than one in four self-payers strongly agree that it is okay to share their log-in so long as someone pays. When they share it’s with an average of 2.3 other users. Think about it this way- for every Spotify or Apple subscriber who shares there are 3 listeners on that account. What we don’t know is whether it’s a lack of understanding about the ground rules, or that consumers simply don’t have any empathy for stakeholders.

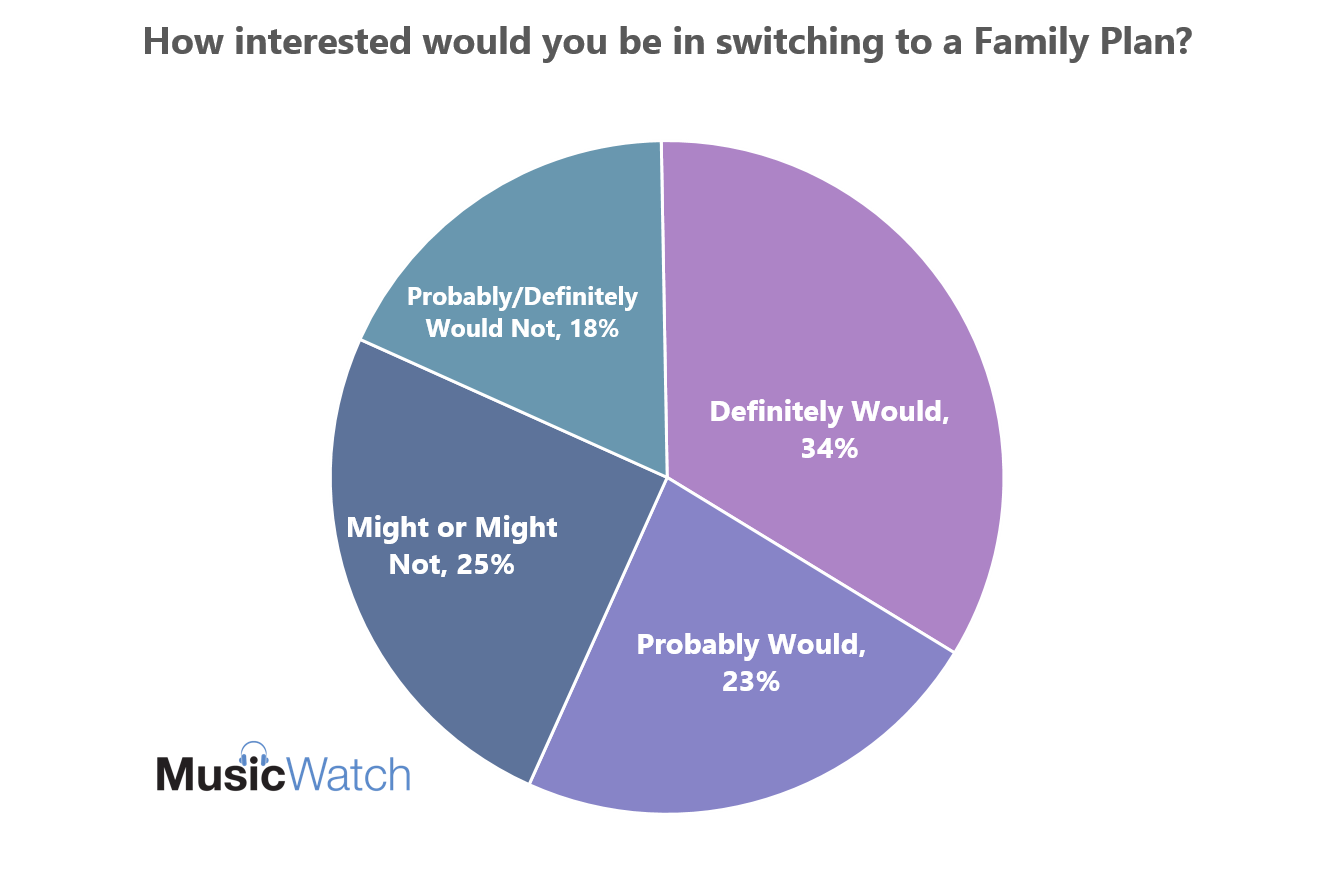

FAMILY PLANS HAVE POTENTIAL AND WOULD BENEFIT FROM STRONGER MESSAGING

MusicWatch research shows that consumers react to family plans favorably. After explaining the key features of family plans, 57 percent of respondents expressed interest in upgrading. Account sharers believe that family plans deliver good value and they like the idea of separate log-ins and playlists for each user. Interestingly only 10 percent think, “it is only fair that they pay for each user on a service.” As noted above many paid users are not aware that their service offers a family plan.

MOST FAMILY PLAN SUBS STICK TO THE RULES

There has been some industry concern that family plan users are not adhering to the terms. For example, Spotify’s terms state that, “the primary account holder and the subsidiary account holders must be the family members residing at the same address.” We asked account holders who they share with:

- 73 percent of family plan account holders share with spouses, partners or significant others residing in the same home

- 44 percent share with children residing in the same home

- 22 percent are sharing with children or family members who do not live at home

- Only 4 percent share with friends who don’t live in the same home

Is compliance perfect? No, but it could be a lot worse. Not surprisingly younger people are more likely to share with friends or roommates, while 35—44 year olds over-index on sharing with children who live away from home.

The math gets a bit fuzzy but one way of calculating annual revenue loss suggests $60M-$120M would be recovered by enforcing geo boundaries on family plans, just among family members4.

FINAL THOUGHTS

Music sharing is not a new phenomenon. My youth was misspent copying music onto cassettes. Who didn’t burn or rip a CD back in the day? Digital sharing itself has evolved from peer-to-peer downloading to stream-ripping and log-in swapping. The problem of account sharing will only compound as consumers are faced with more subscriptions for entertainment and shopping.

One thing remains consistent across these “sharing” formats. There are a lot of music fans participating. Some are aware of the user guidelines5 and willfully ignore them. Many others don’t understand the harm of sharing and agree that “it is okay (to share) so long as someone pays.” The music industry shouldn’t expect consumers to understand the complexity of licensing, but artists and rights holders can help educate and promote good behavior. When the perceptions around family plans are strongly positive the industry needs to take advantage of that goodwill.

Footnotes

-

1.ARPU is average revenue per user. ARPU is a commonly used metric of customer value, based on dividing revenue by the number of subscribers. In practice, ARPU is actually “ARPS” or average revenue per subscriber, since services will have one subscriber and potentially many more “Users”. Although sharing does not diminish the amount each subscriber pays for their music subscription, sharing does diminish the average revenue yield from each user on the account.

-

2.Based on past three month usage among music streamers, at least one hour per week

-

3. ARPU of $93 calculate by using RIAA 1H ’19 estimates ($2.849B revenue/61.1M subs) and extrapolating for full year of 2019.

-

4. Assumes 10M family plans, with 22 percent being out of compliance or 2.2M accounts. If 30 percent were converted to a paid account at $93 annual ARPU, the result would be $61.4M in revenue. If each account had two sub accounts out of compliance the result would be $122.8M in revenue. This is based on family members only. Adding friends, roommates etc. would increase the revenue figures.

-

5. Section 9.11 of Spotify’s user agreement prohibits “providing your password to any other person…”